Financial Planning

Our industry has changed over the years. The regulator, the Financial Conduct Authority (FCA), launched the retail distribution review (RDR) back in 2013. The RDR was the first tranche of several upgrades and essentially served two main purposes:

1. To clean up the industry by making charges clear and transparent

2. To improve the minimum standards of advice, by increasing adviser qualification levels

These changes were well overdue and very much welcomed in many corners of the industry. As a result we have seen the profession evolve. Firstly, from sales people who represented insurance or investment companies (knocking on the door selling pensions), then to traditional Independent Financial Adviser or IFA who would search the whole market and recommend the most suitable provider and finally into Chartered Financial Planners.

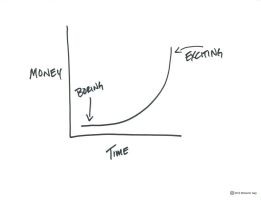

IFAs were seen as the go to people for unbiased and impartial advice on selecting the most suitable financial products. Chartered Financial Planners do this too, but they take it to another level. They build a very deep understanding of a client's resources, circumstances and personal ambitions, which allows them to map out a plan which forecasts their financial future and well-being.

At AIM, we draft this initial plan using a simple spreadsheet and (most importantly) we build it together. We call this the status quo plan. It's a trajectory showing you where you'll be if you carry on doing the same things that you're doing right now. This plan allows us to have conversations about the impact of your decisions. The value is very much in the activity of the planning process and not in a glossy report and or colourful graph.

Financial Planning in this way allows you the peace of mind to know that you are making well informed decisions. Our moto......

Planning for Financial Security, Independence and Freedom!!